Advertisement

OPINIONS

BS25122A 6-Month T-Bill Yield Projection

Yield projection for BS25122A 6-month T-bill.

Tan Choong Hwee

Edited 18 Nov 2025

Investor/Trader at Home

This Opinion post first appeared in my blog here: https://pwlcm.wordpress.com/2025/11/04/bs25122a-6-month-t-bill-yield-projection/

Disclaimer: This post is just for educational sharing purposes. Please do your own due diligence on any products mentioned in this post.

__

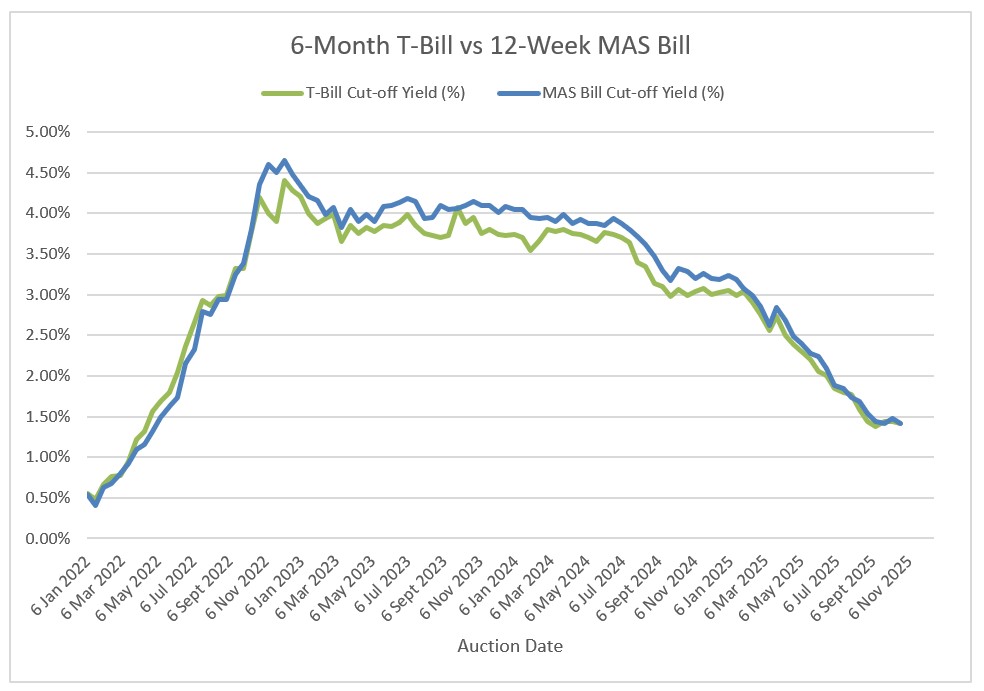

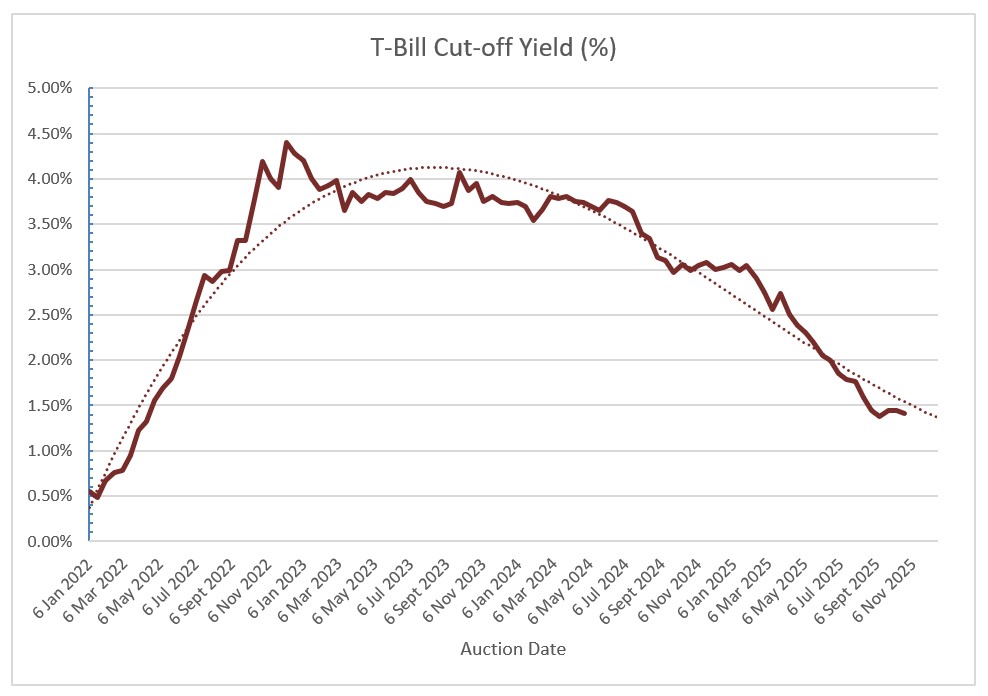

Yield Premium Projection

The updated 6-Month T-Bill vs 12-Week MAS Bill Yield chart and the T-Bill Yield Premium Statistics table are shown below:

The cut-off yield of ML25144N is 1.39%. Considering the 2025 statistics with average yield premium of -0.08% and standard deviation of 0.06%. With that, the projected cut-off-yield for BS25122A would be:

Projected Cut-Off Yield = 1.39% – 0.08% = 1.31% Projected Lower Yield = 1.31% – 0.06% = 1.25% Projected Higher Yield = 1.31% + 0.06% = 1.37%

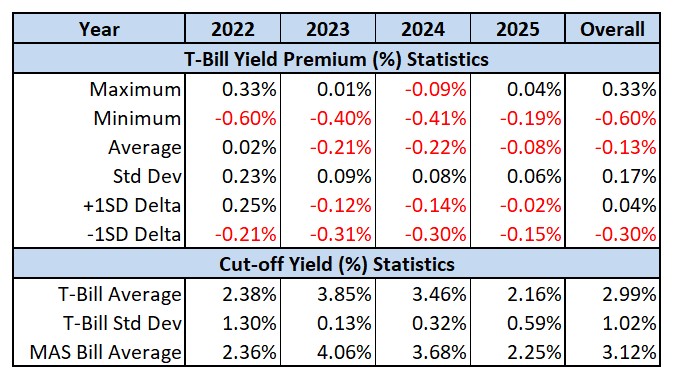

Polynomial Trendline Projection

Based on 3rd Order Polynomial Trendline Projection:

From the trendline projection chart, the projected yield is approximately at 1.48%. With standard deviation of T-bill cut-off yield at 0.59% as seen in the T-Bill Yield Premium Statistics table in 2025, the projected cut-off-yield for BS25122A would be:

Projected Cut-Off Yield = 1.48% Projected Lower Yield = 1.48% – 0.59% = 0.89% Projected Higher Yield = 1.48% + 0.59% = 2.07%

Summary

Yield Premium Projection:

Projected Cut-Off Yield = 1.31%, ranging from 1.25% to 1.37%

Polynomial Trendline Projection:

Projected Cut-Off Yield = 1.48%, ranging from 0.89% to 2.07%

This round MAS Bill dropped 3 basis points from ML25142H 1.42% to ML25144N 1.39%, and the supply of the coming T-Bill BS25122A increased to $8 billion dollars, the highest since I started tracking in January 2022. Together they are going to assert downwards pressure to the cut-off yield.

My projected cut-off yield for BS25122A would follow the Yield Premium Method, i.e. 1.31%.

Comments

16

18

ABOUT ME

Tan Choong Hwee

Edited 18 Nov 2025

Investor/Trader at Home

Blogger, Investor

16

18

Advertisement

No comments yet.

Be the first to share your thoughts!