Advertisement

OPINIONS

Alibaba: The Undervalued Tech Giant

If you want to learn more about Alibaba as a business, you came to the right place. Here's why it may be undervalued 👉🏻

Lin Yun Heng

25 Mar 2021

Senior Analyst at Delphi

I don’t think Alibaba needs another introduction. Everyone’s favourite online shopping mall, Taobao, is taking over China by storm.

With the rising middle class and growing affluence in Chinese demographics, it is no wonder why Alibaba’s move into the E-commerce field was able to garner them so much attention and even labelled as the “Amazon” of Asia, and rightfully so.

Join My Tele Channel Here

Alibaba’s stock price has gone no where in the past few months due to reasons such as rising US-China tensions, the delayed Ant IPO, multiple delisting concerns as well as stronger regulatory curbs from the Chinese government. As a result, investors have decided to sell off their Alibaba shares in pursuit of other opportunities.

While the slew of bad news may seem frightening, Alibaba’s fundamentals remain strong and the recent “discounted” share prices in the past months could provide an attractive buying opportunity.

I personally bought more BABA shares using Firstrade, and it is currently my biggest holding and my highest conviction stock.

Buying Opportunity Arises

With the treasury yield scares and the tech sell off, it presents a huge opportunity to buy into the tech dip and especially with strong companies such as Alibaba who’s fundamentals did not change but was oversold due to fearful market sentiments from inflation fears which I deem as a _short term market noise _since the Federal Reserve already reassured the market that they will not be pulling their QE (Quantitative Easing) any time soon and will continue to support the stock market until their target employment numbers are hit.

That said, I believe equities still have a huge run up until at least 2023 when the Fed decide to change their monetary policy and close their money printing taps.

Business Segments

Alibaba Business Segments

Alibaba is a giant conglomerate with 4 main business segments. Among the 4, Core commerce is their main revenue stream while Cloud Computing, Digital Media and Innovations form the remaining bulk with Alibaba Cloud growing at an exponential rate.

In terms of net income, _all of Alibaba’s net income is from the core commerce _business as currently, its other three segments are yet to be profitable.

Deep Dive into Alibaba

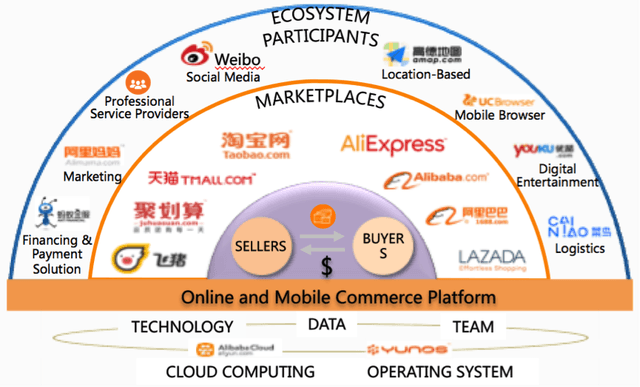

One thing readers should note is that Alibaba is more than an e-commerce company. Although the majority of its revenues still come from its e-commerce business, the company has many other ventures (such as cloud, new retail, local services, fintech etc.) which are all growing rapidly and exponentially.

Below is a brief overview on the business segments in which Alibaba operates in.

Core Commerce

Alibaba’s main business driver is in commerce. In the commerce business alone, Alibaba operates in the following markets:

China E-Commerce

International E-Commerce

China E-Commerce is Alibaba’s fundamental growth driver and what started the company’s growth in the first place. As the main source of revenue generation, this segments operates under different components which includes Taobao, Tmall and Alibaba.com, with the primary goal of connecting buyers and sellers together.

This synergy led to a widespread network effect which essentially drove Alibaba to the top of the food chain, allowing them to capture enormous market share over the years in the Chinese market.

Despite the emergence of new e-commerce players in China such as JD.com and Pinduoduo, Alibaba remains the top e-commerce site in China with over 55% of the market share. This clearly shows Alibaba’s market dominance in the Chinese E-commerce market with competitors far behind in terms of actual market share.

With such a high market share, it creates a huge economic moat for Alibaba to deter competitors. Having such high market share might be a caveat too, as Alibaba was involved in regulatory and anti-trust lawsuits regarding anti-competitive behaviours.

Regardless of the governmental investigation on Alibaba, I believe such news to be beneficial for Alibaba. It may sound counter-intuitive, but allow me to explain:

Once the investigations are complete and there are no corruption cases or fraud accounting matters regarding Alibaba as a company, it will bring about greater transparency and trust among investors and the company itself, highlighting the exemplary stewardship of the management and their business transparency, which in turn will spur long term growth.

Alibaba’s main foreign market is in South East Asia. It operates via Aliexpress, Lazada and Tokopedia (Equity Stake). Tokopedia is the market leader in Indonesia while in the remaining SEA markets, Lazada operates in a duopoly with Sea Limited’s Shopee.

Alibaba is currently facing fierce competition in Southeast Asia but is slowly gaining traction as the emerging market continues to grow with the rising middle class having higher disposable income and choosing to shop online due to the convenience it offers to consumers.

The concern would be whether Lazada is able to fend off competitors in the long run and provide competitive edge against Shopee in the future.

Aside from their core commerce business segment, Alibaba also operate the following:

Local Food Delivery Services (Ele.me)

Retail (Hema Grocery)

Logistics Arm (Cainiao)

Cloud Computing Arm (Alibaba Cloud)

Digital Media and Entertainment (Youku,Alibaba Pictures, Damai app)

These business segments compliments Alibaba’s core commerce segment and aims to create an ecosystem around Alibaba’s existing business lines, which incentivises businesses and customers of Alibaba to use their suite of services and hook consumers, effectively creating long customer lifetime value and ensure recurring revenue streams, increasing adoption of other business segments by capitalising on the existing large pool of users on Alibaba.

Without going into too much details, I believe that Alibaba’s strategy of customer retention is impressive and from an investor’s perspective, this business model is basically impregnable and a 21st century fortress.

Alibaba’s Fundamentals

Alibaba has very solid fundamentals.

Alibaba has a strong cash-generating core business (e-commerce) and it is investing heavily in other businesses to strengthen its ecosystem and competitive advantages.

In the future, the newer business segments such as cloud computing and new retail will likely provide a boost to the company’s bottom line as they are rapidly growing and already command a significant market share in their respective industries.

Source: Morningstar

Source: Morningstar

From Financial Year (FY) 2015 to 2020, revenue and net income has grown at a compound annual growth rate (CAGR) of 46% and 42% respectively. That’s impressive.

Over the next 10 years, I expect Alibaba to continue growing at a CAGR of 20%-30% as they continue expanding other business segments and expand beyond the Chinese market.

Source: Morningstar

Source: Morningstar

In terms of profitability, ROE and ROA shows an incremental upwards trend in the past five years well in the 2 digits.

Although there is a decline in operating margin, net margin looks like it is stabilising around 23%-30% which is a good sign.

Source: Simply Wallst

Source: Simply Wallst

Alibaba has a solid balance sheet and exhibit strong financial health. The company is able to deal with any unforeseen circumstances that can cover any short term liquidity with a current ratio of 1.91 as of FY2020.

From the fundamental analysis standpoint, we can tell that Alibaba is a financially stable company with strong profitability ratios, a wide economic moat backed by a highly effective management team and diversified revenue streams with high cash generation ability while being invested in high growth segments such as cloud computing that continues to grow rapidly over time.

Valuation

In terms of intrinsic value, I personally adopted the DCF model using Sum-Of-The-Part Analysis since Alibaba is a conglomerate consisting of different segments and the terminal value from my calculation turns out to be USD$478/share of BABA in FY2030.

I will not go into the details of how the value is derived and by no means am I a professional analyst as this valuation is self derived, so please note that this is not a financial advise but my own opinion of the stock valuation. Please do your own due diligence.

I believe the upside for Alibaba is yet to be realised and current valuation of its stock price do not do justice to the fundamentals of the company .

From a fair value standpoint, I will buy Alibaba anywhere below $260/share. My current average cost price of my BABA position is $245.80/share.

Conclusion

Always remember to do your own due diligence and understand the company before buying the stock. Buying a stock within your circle of competence and a margin of safety is what will ensure long term growth in the long run.

The current depressed stock price of Alibaba and various other tech stocks represents a huge buying opportunity for the stock, but ultimately one should understand why the stock is even worth that amount in the first place.

Do not rely on hearsay, and take my valuation with a grain of salt. My time horizon for this stock is at least 10 years long and I will be holding the stock even if it declines 50% or more. Know what you own and why you own it.

With anti-trust laws, US-China trade war tensions and Ant IPO concerns, there are imminent risk present when it comes to Alibaba but in the long run, I believe the management and their business model will continue to propel the company even higher and eventually breaking the 1 Trillion market cap which I believe is possible by 2030.

If you are able to stomach the volatilities ahead, with uncertainty in regulatory outcomes and the fierce competition in the disruptive business climate, Alibaba stock looks very attractive and may be worth researching in.

As always, I use StocksCafe to keep track of all my investments (include Robo) + research on stocks. You can also view my portfolio as well as many others so you can compare your own performance with other investors. If you are interested in signing up, you can use my referral link to sign up and access premium features for 1 extra month for new users. (3 months)

Seedly Personal Finance Festival 2021

Oh yes, for those who want to improve your financial literacy and gain insights to some of the best investors of the world or learn more about personal finance, with speakers such as Cathie Wood, Jamus Lim and more, you can join the Seedly Personal Finance Festival which is happening on 10 April 2021 at the price of 1 Nasi Lemak 🙂

Promo Code: YUNHENG40

If you are keen to buy the ticket (while stocks last), you can add in my code to enjoy 40% off your tickets. Simply key in the promo code shown below and checkout.

If an error occurs, simply switch the incognito/private browsing mode and the problem should be solved 🙂

Disclaimer:

The content here is for informational purposes only and should NOT be taken as legal, business, tax, or investment advice. It does NOT constitute an offer or solicitation to purchase any investment or a recommendation to buy or sell a security. In fact, the content is not directed to any investor or potential investor and may not be used to evaluate or make any investment.

Do note that this is not financial advice. If you are in doubt as to the action you should take, please consult your stock broker or financial advisor. (Or contact me!)

Comments

3285

4

ABOUT ME

Lin Yun Heng

25 Mar 2021

Senior Analyst at Delphi

Crypto Educator

3285

4

Advertisement

No comments yet.

Be the first to share your thoughts!