Advertisement

OPINIONS

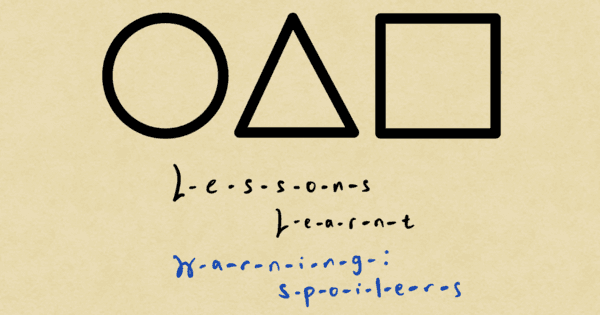

8 Financial Lessons Learnt From Squid Game

There were many personal finance nuggets being highlighted in the show, and here's a summary of them! Warning: Spoilers!

Yu Qi Tan

Edited 10 Oct 2021

Student Ambassador 21/22 at Seedly

Hey Seedly Community! I hope everyone is doing great! This is my first time writing on Opinions and I'm really excited to start my journey here!

If you have been on social media recently, chances are, you would have heard of the term "Squid Game". When I initially heard about it, I was totally baffled! Turns out, it's a Netflix series that has garnered huge traction.

I ended up caving into my curiosity and went to watch the show. Throughout the show, I picked up several key personal finance lessons which were highlighted and I hope to summarise them as well as give my take on them here!

Warning: The subsequent parts of the article will contain spoilers. Do not continue reading if you have not watched the series yet and don't want to get spoiled.

Summary of the series:

A group of 456 participants who each have huge debt problems gather at an unknown location to play a series of games. Whoever wins all games and survives till the end will walk away with 45.6 billion won, or equivalent to USD 38 million.

Lesson 1: Gambling addiction hurts everyone around you

Source: Netflix (Gi-Hun betting on horse racing)

Gi-Hun, the protagonist, is stuck with a huge debt and struggles with gambling addiction. In fact, he even steals money from his mother to gamble. He ends up getting tracked down by loan sharks who chase him down. The huge debts from gambling have caused a strain on his relationship with his daughter, who now lives with his ex-wife.

Gambling addiction will definitely affect the people around you and while it's okay to gamble for good luck and prosperity such as on occasions such as Chinese New Year, understand that one needs to put in the effort to earn his/her keep.

Lesson 2: Greed can blind us

Source: Netflix (All players in the game staring at the prize money, akin to moths attracted to light)

After realizing that their lives are at stake for the games, many of the players wanted to leave the game. However, that required a vote and the games could be stopped only if the majority of the players wanted out. Yet, before the vote, the current cumulative prize money was shown and all the players started having second thoughts about leaving.

It's important to recognize that greed can sometimes blind us, and this may make us fall prey to scams or even get rich quick hooks on adverts that we are seeing more and more today. These scams prey on our greed and it's important to always keep a rational mind and do sufficient research before making decisions.

Lesson 3: Don't over-leverage when investing

Source: Netflix (Sang-Woo confesses that he dealt with Futures)

Sang-Woo confesses to Gi-Hun that he had such a huge debt because he dealt with Futures. Futures are financial contracts where parties are obligated to carry out a transaction at a predetermined price. Sang-Woo probably over-leveraged when he dealt with futures and ended up with a huge debt.

When it comes to investing, it is best that we only invest what we are willing to lose. Furthermore, before even thinking about investing, we should have an emergency fund that can cover at least 6 months worth of expenses. Moreover, we should have insurance that protects our downside as well, which I will explain more in the next point.

Personally, holding good quality companies that are growing at a fast pace has been my investing philosophy ever since I started my personal finance journey 2 years ago. In order to not worry about being margin called when starting out, starting with a cash account for the brokerage will definitely help. Only when you think you are ready for a margin account and know how to responsibly use it, should you then change the account type.

Lesson 4: The importance of having insurance

Source: Netflix (Gi-Hun's mother unable to afford treatment)

Gi-Hun's mother's diabetes is worsening and has no insurance to cover her medical bills. This leads her to refuse treatment, which has serious complications on her health.

I'm sure we all have encountered financial advisors who call us up to see if we need to buy insurance. Some of us get pretty annoyed, and some of us just see it as a good gesture. Regardless, we cannot deny the importance of insurance, given that medical bills in Singapore are quite expensive. The three policies that I think are essential would be life, hospital, and critical illness. Protecting our downside with insurance ensures that we would not be set back financially by too much should we fall ill.

Lesson 5: Do not put all your eggs in one basket

Source: Netflix (Sang-woo advising Gi-Hun before the dalgona candy game)

Sang-Woo advised each team member to choose a different shape, citing that in investing, there's a saying: "Do not put all your eggs in one basket.".

Diversification is indeed important when we invest. However, it's also essential that we do not over diversify as well. Imagine your portfolio holding over 30 companies in the name of diversifying, it would be so hard to keep track of every single investment made. Furthermore, over-diversification will only mean your winners will have a lesser absolute impact on the overall portfolio. I think that we shouldn't diversify for the sake of diversifying, but diversify because we think that a new investment opportunity is a good addition to the portfolio.

Lesson 6: The behavioral part of investing

Source: Netflix (Tug of war game)

The team Gi-Hun was in was not the most ideal, but they still managed to win through strategy, execution, teamwork, and strong mental resilience.

Not everyone has a financial degree, and neither do I. However, investing success is not solely determined by how good you are at crunching numbers or even doing financial modeling, but also determined by how you behave in times of drawbacks. Going back to my investment thesis and fact-checking the facts has always given me the conviction to make a decision to hold/sell/buy more, instead of panic selling. Having a group of friends who can check for my blind spots in thinking has helped to reduce my mistakes as well. Investing is very much a team sport like the tug of war game. Having a financial degree doesn't guarantee success, as seen in Sang-Woo's case and many of the funds that do not beat the S&P 500 in the long run. Don't think that you are disadvantaged just because you don't have a financial degree, because good behavior is much harder to learn than financial modeling.

Lesson 7: The choices you make today will affect your future

Source: Netflix (Gi-Hun making a decision on choosing number 1 or 16)

Gi-Hun had to make a decision in choosing which order he wanted to play the next game in and because he ended up choosing 16, it increased the odds of him winning the game.

Personal finance is ever so intertwined with our lives that we simply cannot ignore it. I think there are several important financial decisions we will have to make as we progress in life. Some of these decisions include buying your first property, determining how big you want your wedding to be, when to start investing, etc. It's essential that we think hard about all these decisions before making them as it will determine how your future finances will look like.

Lesson 8: Look beyond the tangible things for joy

Source: Netflix (The mastermind behind the games having a chat with Gi-Hun)

The old man behind the games confessed that even though he and his friends were extremely wealthy, they could not find joy in living anymore.

We need to look beyond monetary gains for joy in life - be it working on something you really believe in or simply focusing on intangible things such as experiences. While money is important, we shouldn't forget that the most important thing is the time spent with loved ones and the experiences that we get out of living in this world.

Some closing remarks:

Personally, I think the series has managed to gain such huge popularity because the issues highlighted in the series are real issues that are happening in the world, such as the debt crisis that is happening in South Korea. Furthermore, the simplicity of the games further magnifies the brutality of the games. At the end of the day, I think tying back to personal finance, we need to make sure that good financial habits are cultivated from young. We should also realize that money is a tool for us to get to our goals and is not the sole component that influences our happiness. Happiness can be derived from the simple things in life, and all it needs is a change in mindset.

I hope you enjoyed reading this article!

Disclaimer:

The above article is solely my opinion and for informational purposes only. The information presented in the article should not be taken as investment and business advice. In fact, the information presented should not be seen as advice for anything. The information presented is not a recommendation to do anything as well, be it buying or selling any investments. Please do carry out your own due diligence before making any financial decision or seek a certified financial advisor if necessary.

Comments

3728

15

ABOUT ME

Yu Qi Tan

Edited 10 Oct 2021

Student Ambassador 21/22 at Seedly

Product Management and Software Engineering. I write about personal finance at https://yuqitan.medium.com/

3728

15

Advertisement

No comments yet.

Be the first to share your thoughts!