Advertisement

OPINIONS

5 Stocks I Would Buy If The Market Crashes Again

With the market hitting all time highs, are you ready to go in with a game plan if the market really collapses? 🧐

Lin Yun Heng

17 Nov 2020

Senior Analyst at Delphi

This article originated from my blog: Investing Beanstock

Telegram Channel Here

The market has been rallying non-stop on the last few days of the US Presidential Election. The irrational optimism and greed from investors all over the world are pushing stock prices higher even as the pandemic continues to devastate economies around the world. Germany and France went back to partial lock down while USA recorded the highest number of Covid-19 cases in a day at over 190,000.

The vaccine news was shortlived and was a result of the pent- up optimism of face-to-face and travel returning but that view is simply delusional given the current state of the global economy.

Always remember that the stock market is merely a voting machine in the short run: What this means is that stocks go up in the short run due to news, sentiments and expectations, which are not indicators of future performance or earnings growth but merely investors/speculators pricing in to the price they believe the stock would be in the near future. While momentum stocks can generate you fast-and-furious style returns, it can also deliver fast-and-furious losses. (Think NIO,XPENG, Airline stocks etc.)

Word of Caution

So if you are a long term investor who simply does not care what is going on in the short run and would rather focus on the long term growth, then look for qualitative indicators that would suggest above average earnings growth or strong profitability ratios such as ROE 15% for example.

If you are not interested to deep dive into the fundamentals of individual companies, you should not be buying individual stocks.

I repeat. You should NOT be buying individual stocks.

For most people, buying into a Unit Trust or ETF would make more sense given how most people would rush into buying an individual stock without any research and would usually do so on the basis of watching Youtube “Gurus” recommendations, blog recommendations such as this article I am writing right now or recommendations from family members or peers. Buying based on hearing what others say is the best way to lose money and burn yourself in the stock market because you did not do your proper due diligence. So please, take this post with a pinch of salt, and I urge each and everyone of you reading this to do your own due diligence and research into the stocks before buying into them. Don’t be lazy with your money!

As Mr Market continues to be irrational, being the mad man with no logic, I would continue to thread with caution while the market seemed to be too greedy right now. Warren Buffett has taught us that while most people are greedy, that is the time you should be fearful because big expectations and greed can lead to disappointments and fear which is why when stocks go up fast, they go down fast as well.

True value investing takes time and it takes years for returns to show. Most people do not have the patience to stay in the market for long so they focus on short term market noises instead. (Ahem. US Presidential Election Alert).

As I am already about 80% invested, I have 1 final bullet to pump in if the market were to crash (20%) and if it does crash, I will follow my March Crash Protocol and remain calm while waiting for my stocks to recover. I held steadily during the March Crash, tolerated a -33% drop and watching it recover to hit my personal record of +54.08% year-to-date. That is largely a result of my US stocks position (80% of my portfolio) which recovered and hit multiple all time highs.

My Current Portfolio Diversification (StocksCafe)

80% US Stocks/ETFs + 20% SG Stocks (REITs)

My current Portfolio + Diversification. (22 stocks + Syfe Equity100) YTD +52.08%

My current Portfolio + Diversification. (22 stocks + Syfe Equity100) YTD +52.08%

I sold off majority of my SG stocks (at a profit) and currently only holding on to 2 REITs which I bought during the market bottom on 24 March and 3 April respectively. I was lucky and brave enough to buy during the lows and I must say it was really more difficult to do than just pure theory. Doing is usually much harder than understanding so to actually understand investments, you have to dip your hands in it yourself.

I have seen numerous financial advisors advocating investments when they themselves don’t even invest. Most of them follows a script and knows at best about market indexes and simple ETFs/Robos, which are really just surface level knowledge because** **true knowledge comes only if you are in the market yourself and dabbling with your own stock picks.

If you need help with investment advice, or need guidance over financial planning or planning your future with a great wealth portfolio, you can reach out to me here. I am more than willing to help out!

Investing is tough and so is mapping our future, I hope to touch the lives of my readers and not only provide just self-help financial knowledge, but to also advocate the importance of financial planning and starting early, so that each and every one of us can retire early and reap the benefits of our hard work in our later years.

I personally got inspired to invest and work towards my retirement after reading blogs such as mine which is why I feel the need to give back to the readers, and hopefully inspire like-minded individuals to share their experiences and knowledge with the rest of the world and help each other to work towards financial freedom and one day escape the Rat Race.

Moving on, I have a Personal Watchlist of stocks which I will get my hands on or average into in case the market tanks again. Do note: These are stocks which I have done my research and due diligence on already, fits my investment horizon and align with my personality and outlook. These stocks may not be for everyone and returns are not guranteed. Invest at your own caution. These are not stock Buy/Sell calls and merely my own opinions for my own investment needs.

Brokerage Platform Used: Firstrade

Oh, and for those curious with what platform I use to buy stocks, I use Firstrade Brokers and you can read up more about it here.

1. ARK ETFs (Ticker:ARKK, ARKW, ARKF)

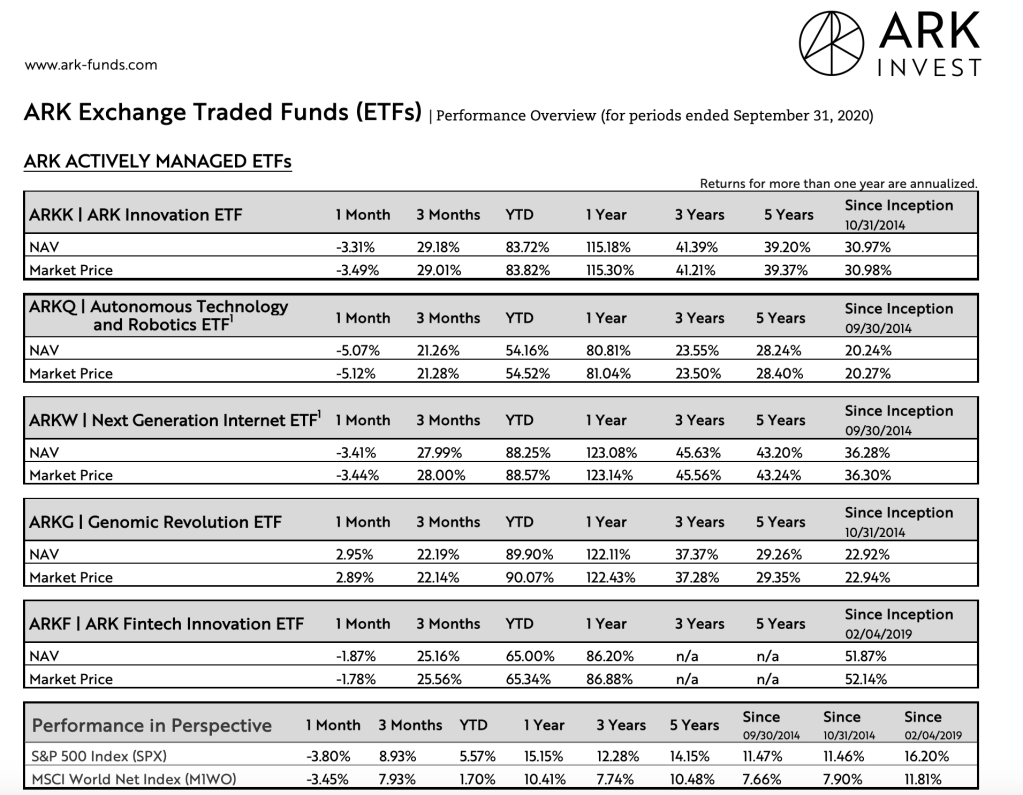

As one of the best performing ETFs this year, Cathie Wood’s actively managed ETFs managed to find industry breaking stocks for the future and I like these ETFs a lot. Forget the traditional notion of what a good ETF must be (low expense ratio, highly diversified, passively-managed index funds), because if you are not open minded, you are missing out a lot of returns because there are great investments out there you have yet to explore.

ARK’s funds have been specifically focused on companies that are pushing boundaries in their respective fields and have a ton of optionality. This selection process has an important impact on time horizon, with holding periods of several years required to see a bullish thesis materialize. Are they all winners? Certainly not. But the companies that deliver on their premise are driving a portfolio performance above and beyond what any investor could dream of.

The returns speak for itself and if you want to read up more, you can go to their website here.

I currently hold 3 of ARK’s ETF, which are ARKK, ARKW and ARKF. If the market were to crash, depending on which one has a steeper decline, I will average in more into that particular position due to the bigger margin of safety. If the ETFs were to crash beyond my cost price, I won't mind going all in on my final bullet into these 3 ETFs since they really outperform the market by a FAR MARGIN which makes the S&P 500 or NASDAQ-100 index look like child's play.

2. Salesforce.com (Ticker:CRM)

Salesforce is an enterprise software maker and American cloud computing giant which provides customer relationship management (CRM). With Work-From-Home trends as a result of the pandemic, demand for next-generation collaboration and productivity tools has increased. Many companies aim to automate operations and track key business metrics in order to support employees working from home. It has also recently been added to the Dow Jones Industrial Average, which is basically the top 30 companies of the United States, replacing Exxon Mobil.

They are poised to continue growing at a rapid rate as they expand their network effect to more markets with more companies and enterprises transitioning towards cloud. Since the stock looks overvalued at the moment, I will be glad to add if the market were to tank, allowing me to get in at a bargain for the long run.

3. Taiwan Semiconductor (Ticker: TSM)

This is practically a monopoly when it comes to semiconductor technology and the world’s most valuable semiconductor company. It is the largest dedicated independent semiconductor foundry.

In terms of technological advancement in the semiconductor industry, TSMC is the first foundry to provide 5 nanometer production capabilities which was applied on the new Apple A14 Bionic Chip (iPhone 12, iPhone 12 Pro, iPad Air (4th Gen). TSMC is the first to achieve 5nm production capabilities in the industry and their network effect is extensive. They have big name clients relying on their technology such as Apple, AMD, Nvidia and Qualcomm.

With solid balance sheet and high profitability ratios while providing dividend streams, this is a growth+dividend monster which I am extremely confident about. If market were to crash, I would definitely buy into TSMC. (And I will buy in BIG.)

4. Apple Inc. (Ticker: AAPL)

This company needs no introduction. You are probably reading this right now with an Apple product, be it the iPhone, iPad or Macbook, Apple has established itself to be one of the most prominent tech company out there with its own unique OS and product differentiation from the rest of the market.

There is a reason why Apple remain as Warren Buffett’s biggest stock holding in his portfolio, and that’s because of the wide economic moat Apple has, and the allure of its product that make brand switching so difficult, which means a loyal client base that is willing to buy their products no matter how high price they mark up their products.

Network effect, strong brand presence, product differentiation and a cult of Apple fans chasing after the next Apple product year after year proves that Apple’s business model works, and is really good at that.

From the fundamentals standpoint, Apple’s balance sheet are rock solid, with an ROE of 73.69% and ROA of 12.51%. Without being too technical, Apple basically is a fortress and competitors are having a hard time winning customers away from Apple. Apple don’t just sell phones or tablets, they are selling a service, they are selling you an experience, whether its unboxing, setting up your devices or a trip down to the Apple store. That is what makes Apple so successful.

5. Tesla Inc. (Ticker: TSLA)

The world most controversial, most hated/loved (depending on which side you are on) and one of the hottest stock this year, Tesla Inc, the electronic vehicle maker, helmed by Elon Musk, is one of those stocks where you are either a skeptic or you swear by it.

It took me a long time of convincing and research to fully understand its business model, its future growth prospects and economic moat, as well as the overvalued price point which I succumbed to and realise this stock truly knows no limits. But one reason why I was sure that Tesla was worth an investment was when I ask myself the question: “In 20 years time, will I be driving a diesel fuelled car? Or an electric car?” And the answer is clear: Electronic vehicle is the future just like iPhone was the future when everyone was using Nokia.

Innovation Curve: Taken from ARK Invest website

Innovation Curve: Taken from ARK Invest website

Even though Tesla may not be making huge profits now, I believe that given Elon Musk’s foresight and leadership and their_ first-mover advantage, Tesla is poised to grow even faster if they were able to achieve economies of scale and scale up their business globally, and when innovation eventually hits the mass adoption stage, that is when everyone who thought Tesla was a joke would start regretting and join the FOMO dumb money to invest in it at all time highs while Tesla becomes the indestructible fortress just like Apple.

I currently own Tesla stock myself and if their stock prices were to crash and retract to the $300 levels, I would be glad to buy into the stock.

Bonus 3 Stocks!!!!

Still reading? THANK YOU!

_To reward your viewership, here are 3 other stocks _on my Market Crash Watchlist which I would be glad to buy if they also hit my fair value estimates:

Alibaba Group Holdings ADR (Ticker: BABA)

Mastercard Inc. (Ticker:MA)

Tencent Holdings ADR (Ticker: TCEHY)

Conclusion

I am currently invested into the 5 stocks mentioned above with varying percentages within my portfolio. Given the growth potential of the stocks mentioned, I am LONG on these positions and would be happy to buy in more at a bargain if the stock market were to crash again. All 5 stocks are tech related and may not suit everyones’ investment portfolio as everyone has different needs, time horizons and circumstances that are unique to each of us.

There is no one-size-fits-all solution when it comes to investing. Each individual’s portfolio should be highly customised just like your own taste and preferences, fashion sense and sense of humour. Hence, you may need proper needs analysis done before heading into any investments as it is a long-term commitment. If you need any help, you can reach out to me here.

As a 21 years old with more than 30 years time horizon ahead of me, I am willing to withstand market volatilities and fluctuations and would be holding onto my stocks because the reason why I bought them in the first place is because of how good the companies are and I am confident of their growth in the future, which would reap me with the rewards for having faith in them.

If the market does crash, I will most likely allocate 50% of my remaining warchest to the 3 ARK ETFs (depending on how much each ETF drops) and the remaining 50% to the other stock positions (depending on the extent of crash on each individual stock). I will be holding on to these stocks for the long run unless it fits my sell criteria.

So there you have it! My thoughts on how to position going forward and if markets were to crash, that would be my gameplay ahead. I would love to hear your thoughts, let me know what you think!

I use StocksCafe to keep track of all my investments (include Robo) + research on stocks. You can also view my portfolio as well as many others so you can compare your own performance with other investors. If you are interested in signing up, you can use my referral link to sign up and access premium features for 1 extra month for new users. (3 months)

Disclaimer:

The content here is for informational purposes only and should NOT be taken as legal, business, tax, or investment advice. It does NOT constitute an offer or solicitation to purchase any investment or a recommendation to buy or sell a security. In fact, the content is not directed to any investor or potential investor and may not be used to evaluate or make any investment.

Comments

10925

22

ABOUT ME

Lin Yun Heng

17 Nov 2020

Senior Analyst at Delphi

Crypto Educator

10925

22

Advertisement

No comments yet.

Be the first to share your thoughts!