Advertisement

OPINIONS

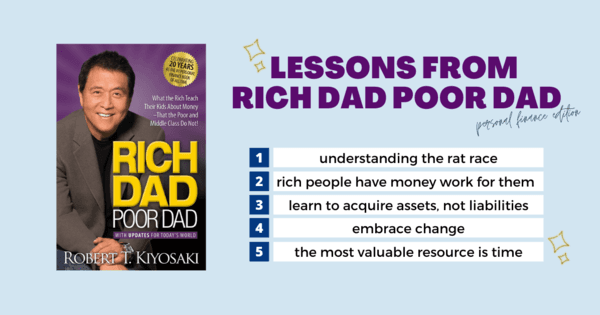

5 Lessons from Rich Dad Poor Dad on Personal Finance

Changing the way I view money and making important financial decisions.

Shania Loh

31 Dec 2020

Seedly Student Ambassador 2020/21 at Seedly

After expressing an interest to expand my knowledge in personal finance, my friends highly recommended me to turn to books written by professionals. Rich Dad Poor Dad by Robert T. Kiyosaki was one of them.

This book is by no means a “guide to investing 101” or a “tips to personal finance” kind of book, but it has definitely shaped the way I view money and manage my own finances for many years to come. I decided to share some of the key lessons and reflections of the book here as a way to look back on the very first book that got me to start reading on personal finance and to impart some lessons to beginners looking for a way to start their own finance journey.

Source: Tenor

1. Understanding the rat race

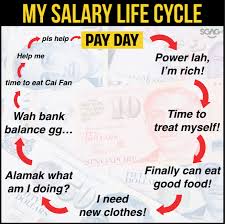

Kiyosaki has highlighted very early on in the book the meaning of a rat race and how the majority of us are stuck in this vicious cycle. We’ve heard it many times from our parents that we have to “go to a good school” and “get a stable and high paying job”. Most of our lives will be spent working towards this goal, only to realise that we spend an equal amount of time paying off our liabilities – a house or a car - and only saving the rest for our retirement. We’re expected to live from pay check to pay check (even with proper budgeting), and somehow still have enough left over for us to meet our needs and wants, and retirement.

Source: Sgag

Kiyoshi explained that in order to live comfortably without worry, we have to learn how to beat inflation by accumulating our wealth through our own investments, or businesses. The sooner we realize how to do so, the better.

You can read up more about the importance of understanding and escaping the rat race here.

2. Most people work for money – Rich people have money work for them

The rich learn the value of becoming their own boss as early as possible in their life, to leverage on assets and its people to continuously earn money. The rich think of ways to innovate and step out of the box to escape working for money for the rest of their lives. Just think about how Jeff Bezos or Elon Musk has more than enough money to retire, but he continues working anyway. They have their money work for them through their businesses whereas most of us would think about having a stable job as a way to make money and generate a basic income for themselves.

There is no doubt that starting a business is tough, but with an entrepreneurial spirit and drive and as the business becomes more profitable, you would be able to invest these profits back into the business to generate more income for yourself. You get to set your own rules by working for yourself and your own goals instead of someone else’s. You are in complete control of your personal and business direction.

Source: Tenor

I’m not saying that you should completely drop your full-time job right now, but it is something worth thinking about. Ultimately there are various ways to accumulate your wealth - you can still have a stable 9 to 6 job and invest heavily on the side (therefore having your money work for you and beat inflation!), and still have the option to retire early. Everyone’s path and preferences are different, but Rich Dad Poor Dad has opened my eyes on the importance of having my money do the heavy lifting for me, and not the other way round.

3. Learn to acquire assets, not liabilities (and understanding the difference)

What’s the difference between an asset and a liability?

An asset is something you own that is of value and can be used to produce revenue. For most of us, the most common asset we will have is cash. A liability is a debt or something you owe. This includes credit card bills, insurance bills, or mortgage loans.

Most people would think that a house is the biggest asset that they ever have. Although that may be true to a certain extent since a house can increase in value over time, unless you bought a house to be rented out, it is not an income-generating asset. Other income-generating assets include stocks, investment funds, etc. With the maintenances fees and loan installments you have to pay for the house, it serves more as a liability that you pay off, rather than an asset.

The thing about the rich is that they are quick to identify and understand the clear difference between an asset and a liability. They invest heavily in assets to let their wealth accumulate and money work for them. Rich Dad Poor Dad hopes to spread awareness to people to generate more cash flow by identifying strong valuable assets and keeping their liabilities as low as possible.

Acquiring assets helps to ensure that you are able to consistently earn a significantly higher amount of income over the years and eventually be sufficient for you to live comfortably (hence having the choice to retire early!) and just let your money work for you (point 2).

4. Embracing change

Personally, I understand how daunting it can be to start planning your own finances, budgeting, making lifestyle changes in order to meet my own long term financial goals, but change is necessary in order to break out of the rat race and be financially free.

Building wealth might take some big changes, such as giving up your high social life to set aside more money to your savings or investments. You have to be bold enough to go ahead with such big behavioral changes in order to achieve your financial goals. Rich Dad Poor Dad shares how the rich started grinding and hustling early to be where they are today despite all the criticism. We have to be strong enough to persevere make the changes, no matter how big or small. All it takes is a single step to start!

Source: Tenor

If you want to change your own status quo and start growing your wealth beyond your stable pay cheque, I’ve left some of my favourite Seedly articles on ways you can start investing here:

https://blog.seedly.sg/beginner-investing-strategies/

https://blog.seedly.sg/ultimate-personal-finance-guide-to-investing-singapore/

https://blog.seedly.sg/guide-to-robo-advisors-singapore-comic/

https://blog.seedly.sg/checklist-to-do-before-investing/

https://blog.seedly.sg/the-ultimate-beginners-guide-to-picking-your-first-stock/

Seedly has also created an ultimate guide to kick start your personal finance journey. You can read more about it here.

5. The most valuable resource in the world isn’t money, its time

One of the main takeaways I’ve learned from Rich Dad Poor Dad is the key aspect of time. The true power of time can be seen when our investments compound and amass a greater value over the years. Beyond investments, time spent on improving and educating yourself in other areas, such as personal development, is just as important. With that said, it is still not too late to start, and the best way to have time on your side is to begin today.

Source: Tenor

Closing Thoughts

It takes time and effort to acquire knowledge about personal finance to build a lifetime of wealth. Rich Dad Poor Dad also highlighted the importance of knowing skills related to accounting, investing, the stock markets, law, sales, marketing, leadership, writing, speaking and communication, regardless of what job sector we may be in. We should aim to continuously learn, grow and improve ourselves in our lifetime. After all, you are your own biggest investment.

Source: Tenor

Always dream big and do not limit yourself to what you can do (or earn $$$). Set clear goals for yourself in terms of what you want to achieve.

Rich Dad Poor Dad is a good beginner book for anyone starting out on their personal finances as it deals with shifting your mindset in the way you view and manage money, which in my view, is the most important step.

Now that I am more aware about the importance of personal finance and investing, I’d love to read more in-depth to expand my knowledge. Feel free to share any book recommendations (finance, investment or personal development related) in the comments section below as well! :)

Comments

4345

12

ABOUT ME

Shania Loh

31 Dec 2020

Seedly Student Ambassador 2020/21 at Seedly

A curious individual who is eager to learn more about personal finance and investments.

4345

12

Advertisement

No comments yet.

Be the first to share your thoughts!