Advertisement

OPINIONS

5 Common Mistakes Investors Make & How To Avoid Them

Here are the 5 most common mistakes investors make

Gavin Tan

15 Mar 2021

Founder at sgstockmarketinvestor

This article originated from sgstockmarketinvestor

Join My Telegram Channel Here For More Updates!

With the recent market crash due to the covid-19 pandemic, there has been a huge inflow of investors coming into the market. With such a huge inflow of new investors joining the market, there is bound to be a ton of newbie mistakes being made by these investors. For the past few months, I've seen countless investors making silly mistakes, causing them to lose a big portion of their portfolio. As such, I've decided to write up the 5 most common mistakes investors make and how should an investor avoid these mistakes.

1. Not Doing Sufficient Research Before Investing

The #1 thing I hear most when I ask new investors why they bought a certain stock is "because it was running up". This is, by far, the worst reason to invest in any stock. This shows a classical example of FOMO, fear of missing out, whereby an investor is afraid that they might miss out on some quick bucks so they panic and buy the stock now, hoping that it will continue to go up.

More often than not, when there is too much FOMO lying around, the stock price will soon start to fall rapidly due to investors and traders that got in early, taking profits. This will leave the FOMO investors stuck near the peak, wondering what they should do with their losses.

The best way to avoid this mistake is to actually do your own due diligence, researching the company, reading financial statements and watching interviews given by the upper management regarding the company's progress. This way, you will have the conviction to buy and hold the stock even when the price tanks.

2. Overly Concerned About Daily Fluctuations and Volatility

Many new investors are not used to the daily fluctuations that happen in the stock market. I remember when I first started investing, whenever my portfolio went up by 1%, I would be in such a good mood but whenever it fell by 1%, I would panic and wonder if I should sell.

This went on for a few months until I realized that the only thing worrying, did for me was affect my mood like a rollercoaster. Regardless if the stock price went up or down, the company is unaffected and still operates the same way it has been operating.

Once I internalized this, it was very easy for me to look at the market without being affected by the price volatility. I believe that new investors should try to internalize this as well so that they won't be affected by the day to day fluctuations. If an investor is still affected by the volatility, they should just avoid looking at the market in general and just invest for the long term, maybe even invest in ETFs and Robo advisors.

3. Lack Of Diversification

I'm sure you have heard that it is important to diversify, not putting all your eggs into 1 basket but many don't actually know what that means. New investors practice poor diversification by simply buying a bunch of random stocks, some of which they don't even know or understand, just so that they are "well-diversified".

This is among one of the most common mistakes made by investors and there are a few ways one can do proper diversification. I'll be sharing 3 simple ways an investor can do proper diversification with their portfolio.

Diversify With ETFs

This is by far the easiest method to diversify as you just need to buy ETFs, which are basically a basket of stocks. This method allows an investor to gain exposure to a basket of stocks that come from different industries or different geological regions or are of different asset classes.

In my opinion, the best way to diversify with ETFs is to invest in global ETFs such as the Vanguard Total World Stock ETF (VT). One could also opt for Robo advisors such as Stashaway which also invests in global ETFs and across different asset classes.

Diversify With Cyclical Stocks

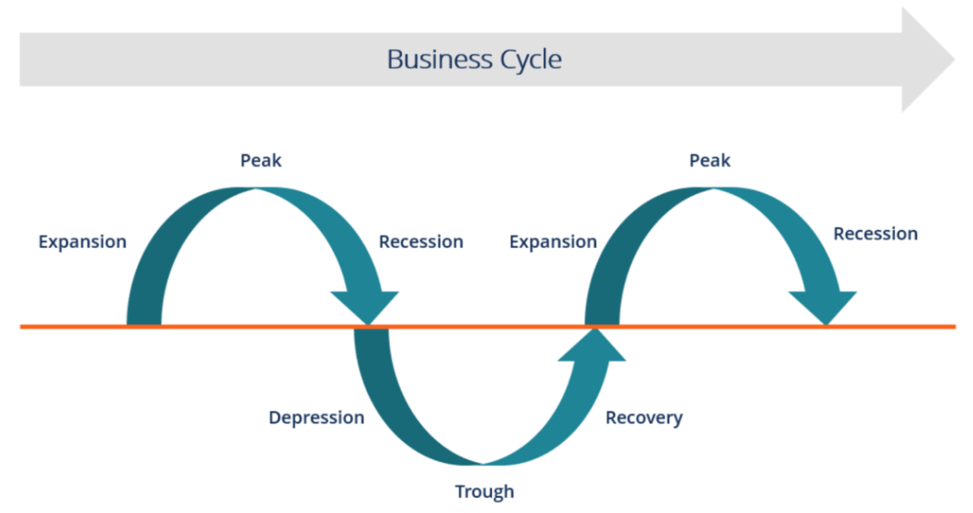

Diversifying with cyclical stocks is to own a portfolio of stocks that will benefit across different cyclical periods. In a normal economic cycle, just like the business cycle below, there are always ups and downs as time passes.

During the ups, cyclical stocks will do very well such as banks, retail, and hospitality REITs. During the downs, the noncyclical/defensive stocks will perform very well such as consumer staples and industrial REITs. This strategy is to own a portfolio of about 50% cyclical stocks and 50% noncyclical stocks. This enables an investor's portfolio to consistently perform regardless of the economic cycle.

Diversify Across Strategies

The last method is a little more complicated as it involves knowing a few investing strategies such as growth investing, dividend investing, etc. Essentially, if an investor chooses to diversify across strategies, the investor will slice up the portfolio into pies and focus each pie on 1 investing strategy. For example, an investor could have 30% of his/her portfolio made up of growth stocks, 30% in dividend stocks, and 30% in value stocks, and 10% in momentum stocks. This would create a form of diversification as the portfolio is made up of stocks that are of very different natures and industries.

Typically, growth stocks are in growing industries such as tech and are usually fairly young in the market. This allows them to grow larger in size as time passes and as the company progresses. Dividend stocks tend to be mature companies that have already progressed from their growth phase and are now seeing slow but consistent results year over year. These companies provide a certain form of stability as the company has to be in a profitable state before handing out dividends.

Diversifying across strategies allows an investor to be more flexible and open up their portfolio to various opportunities that they won't usually be in contact with. For example, a value investor would never invest in high growth, loss-making tech stock but if he/she chooses to adopt this method of diversification, the investor will be exposed to some form of high growth tech stock.

4. Booking Profits Early & Holding Onto Losers

Another common mistake investors make is the fact that they always take profits too early and hold their losers for too long. The most common phrases I hear investors say are, "I sold because I think it is starting to look expensive" or "I am still holding because I think it will bounce back soon".

There is 1 key issue with both phrases here, "I think". If your reasoning for doing a trade is because you think something is happening, you shouldn't have gotten yourself into that trade in the first place. You should have done your due diligence before you even got into that position.

The only way you can avoid this mistake is to form your own analysis and game plan before you take any position. This way, once you have taken the position, you just need to follow your game plan. For example, when I invest in high growth US tech companies, my game plan is fairly simple. As long as the company's overall business and fundamentals haven't been changed, I won't sell.

5. Trying To Time The Market

Last but not least, the mistake that all investors make, new and experienced, trying to time the market. Every investor wants to buy at the absolute low and sell at the absolute high so that they can reap the biggest profit. This, however, is very unrealistic as there is almost no clear way to determine the absolute bottom and top, even with technical or fundamental analysis.

The best thing investors can do to avoid this mistake is to have a game plan and follow through with it. A game plan could be dollar-cost averaging every month or setting a fixed entry and exit price point and following through with it. This way, emotions are out of the way and you can focus completely on your game plan.

Final Thoughts

I hope that this list of common mistakes investors make can help not just new investors but experienced ones as well. Investors must keep an open mind and stay flexible. This way, it is easier for one to learn from mistakes and improve.

I myself was once a new investor and I personally made some of these mistakes as well when I first started. I do look back and regret but I am happy that I learned from my mistakes early in my investing journey. I hope that you can also learn from my mistakes and have great success with your investing journey.

As always, you can take a look at my portfolio updates to see my current positions! Also, use my referral code for an extended 3 months of premium access to StocksCafe!

Comments

244

0

ABOUT ME

Gavin Tan

15 Mar 2021

Founder at sgstockmarketinvestor

Hey there, I’m Gavin! I'm the founder and author of sgstockmarketinvestor.com

244

0

Advertisement

No comments yet.

Be the first to share your thoughts!