OPINIONS

3 Investment Lessons Learnt From the Netflix Series: Alice in Borderland

Warning: Spoilers Ahead! Avoid reading if you don’t want to get spoiled.

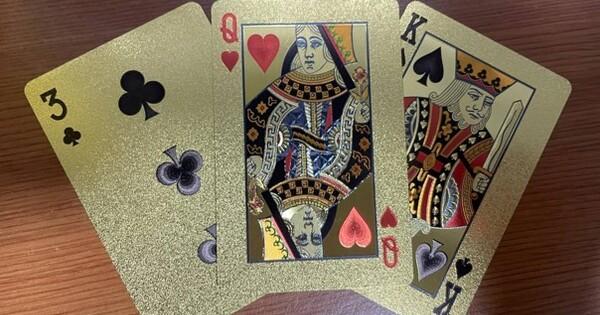

Netflix recently released the 2nd season of the thriller show: Alice in Borderland. For those who have yet to watch the show, to set some context, this series is basically about a group of people having to compete in games in an alternate world that is equipped with advanced technology. The games have different levels to it, and each level is represented by a playing card. The difficulty level increases with the number on the card, while the suit on the card represents the nature of the game that they will be playing. In most games, the winner of the game gets to live on and continue playing the other games till they finish collecting the whole set of playing cards. The loser of the game will be eliminated and will be shot by a laser beam, if they haven’t already been eliminated during the game itself.

While watching the show, I realised that I could relate some of the games to investing. To avoid including too many spoilers, I would only talk about 3 investment lessons I learnt from 3 of the games.

Lesson 1: Without a clear strategy, your irrational decisions may be costly.

In the first season, the players participated in the 3 of Clubs game named, Dead or Alive. It was a game where participants have to choose between two doors, one was marked with the word ‘Live’ while the other was marked with the word ‘Death’. The word on the door did not necessarily translate to the correct door that they should choose. The aim of the game is to enter all the right doors within the time limit and escape the building. Choosing the wrong door will lead to their death.

At the beginning of the game, one of the players decided to rush into one of the doors as she succumbed to the pressure of the game. Unfortunately, she selected the wrong door and got shot by a laser. Eventually, the other players cleared the game successfully by following a clear strategy to beat the game based on the structure of the building and their memory of an escape plan map. This can be likened to investing whereby we should always have a clear and well-thought-out strategy before we start investing. Though the consequences of a failed investment strategy are not as serious as making the wrong choice in the show, the point here is that we should always aim to be rational and have a clear plan. We should not rush into buying a particular stock just because of hype or peer pressure.

Lesson 2: Investing is a mental game.

In the second season where the players have to take on supposedly more challenging face card games, we were introduced to the Queen of Hearts game named, Croquet. To win the game, players have to simply complete 3 rounds of croquet with the gamemaster without forfeiting. Winning the game wasn’t even a requirement. Sounds simple, isn’t it?

During the game, the gamemaster tried to manipulate the player by tapping into his desire to find out more about the world he was in. With the help of an hallucinant she added into the tea, she tried to trick him into believing some incidents that weren’t even real. The player was put to the test mentally and almost gave in. Eventually, he was saved by the actions of the other player present and came back to reality. Investing is a mental game as well. Very often, we can be affected by the volatility of price movements and start to panic. Furthermore, we may be affected by what others might say about certain investments. Emotional investing can be very dangerous and costly. We must always stay resilient and not be easily manipulated into making certain decisions.

Lesson 3: Be prepared for tough times

Arguably the most challenging game, the King of Spades also known as Survival was a game whereby players have to avoid being gunned down by a highly skilled mercenary. The game area was the entire Borderland and the King of Spades can show up at anywhere, anytime. The only warning sign of his presence was his blimp that followed him everywhere he went.

In the show, very often we see that the King of Spades appears at very unexpected moments, and many failed to escape in time as they weren’t prepared. Wherever he goes, there will be warning signs such as the presence of the blimp. Just like the King of Spades, an incoming recession will first present certain warning signs such as drastic interest rate hikes etc. Investors should always be ready for such situations and have a clear strategy in place to tide through the difficult wave.

Final thoughts

In conclusion, these are just some of the more important investment lessons I took away from watching the series. Hope that you enjoyed reading the article and hopefully these lessons are relatable and useful for you as well. Thank you.

Disclaimer: The opinions expressed in this article are based on my thoughts on the series and are solely for informational purposes only. It does not constitute financial advice and I will not be held responsible for any investment losses resulting from applying any of the information mentioned above.

Comments

1204

8

ABOUT ME

1204

8

No comments yet.

Be the first to share your thoughts!