Which would be a better choice? DCA in roboadvisor (stashaway / syfe) or directly into S&P500 & world ETFs?

Im planning to set aside $1K monthly for investment.

for the latter, im concerned about the fees required for each transaction. im currently using stanchart online trading so its $10.7 per trade.

4

Discussion (4)

Learn how to style your text

Eliezer

26 May 2020

Content & Community Lead at Syfe

Reply

Save

Hey there!

Roboadvisors craft out a portfolio based on your risk appetite. That will be different from you investing directly into an ETF so you might want to evaluate to see which is your preferred. Robos have higher fees as well. Also you might want to opt for an online broker compared to local bank brokers due to higher fees if you are investing directly.

Financial planning is an integral part of life. You can reach me here to find out more.

Reply

Save

DCA in roboadvisor is more cost-effective in my opinion. I have been DCA in StashAway and Syfe (100%...

Read 2 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Products

StashAway

4.7

1293 Reviews

StashAway Simple Guaranteed 3.55% p.a. (Guaranteed rate)

Cash Management

INSTRUMENTS

None

ANNUAL MANAGEMENT FEE

None

MINIMUM INVESTMENT

3.5%

EXPECTED ANNUAL RETURN

Mobile App

PLATFORMS

Syfe

4.6

930 Reviews

Moomoo Singapore

4.7

478 Reviews

Related Posts

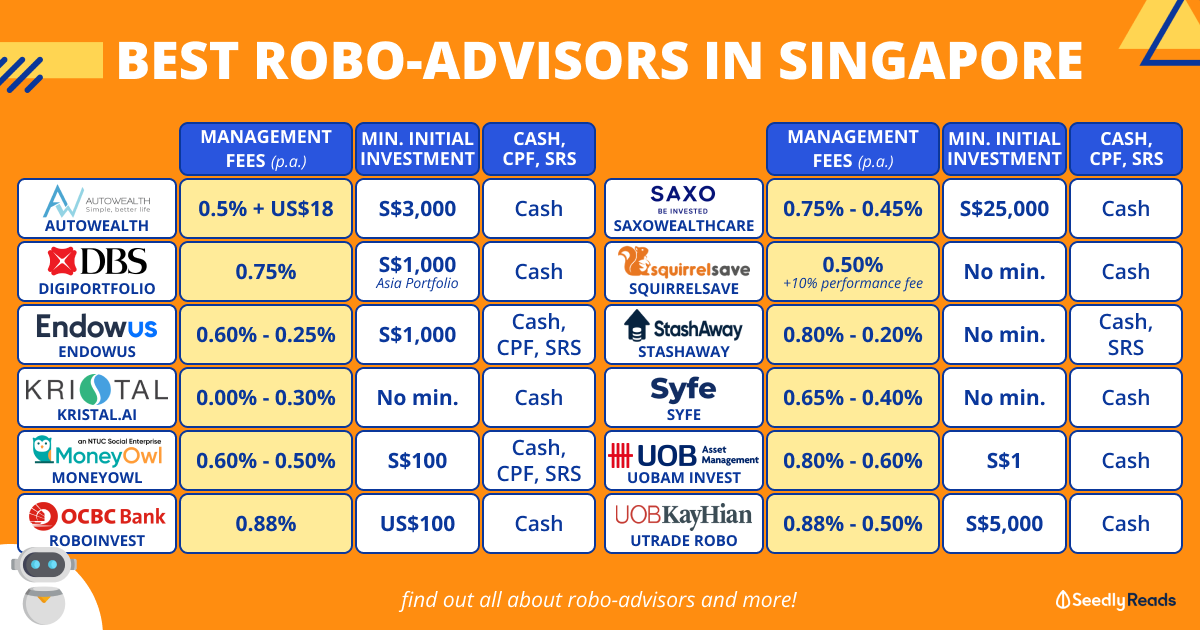

Hi W, that's a good question! When you DCA with Syfe, there are no trading / brokerage costs to be concerned about. Such costs can add up and eat into your returns, so a platform that absorbs these costs for you would be a better choice over time. Moreover, as your AUM grows, your Syfe management fee falls (our fees are between 0.4% to 0.65% per annum).

If you don't really have the time to manage your own portfolio, Syfe offers a hassle-free, ready-made ETF portfolio that is diversified across asset classes, sectors and geographies. Your portfolio is also risk managed to help protect and grow your wealth.

To help you boost your returns, dividends are automatically reinvested for you at no additional charge. We will rebalance your portfolio for you when necessary as well - for free!