TL;DR: Fraser & Neave stock is trading near its 52-week low. FY2018 profits increased 27% and 1H2019 profits jumped 80% YoY compared to 1H2018*. Lets take a look at the summary of this stock!

Business overview

Established in 1883, Fraser and Neave, Limited (“F&N”) is known by us more for its drinks, including 100 plus, F&N drinks, Ice Mountain, Vinamilk and Chang Beer. Under F&N Limited there is not just the Food & Beverage but they are also in the Publishing & Printing industry - Marshall Cavendish (such as some of our textbooks!), but this post will mainly talk about their F&B segment.

Share price

Credits: Yahoo Finance

Currently, F&N Limited is trading at $1.74 (as of writing on 15 May 2019), with the 52week L/H at $1.67/$2.10. The current P/E ratio is 16.36.

*1H2019 profits jumped 80% YoY compared to 1H2018, calculated based on attributable profit before exceptional items, comparing 6 months to 31 March 2019 to one year before (6 months to 31 March 2018).

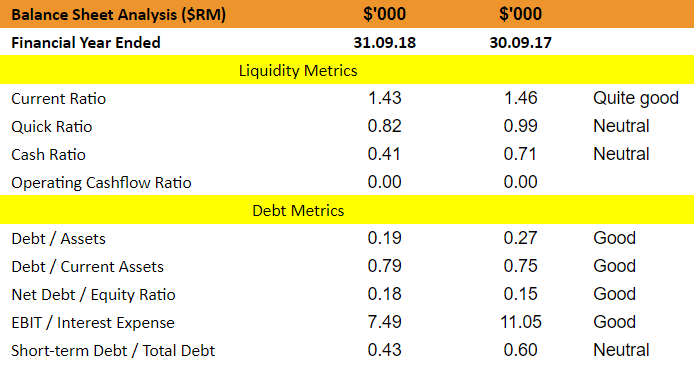

Financials

In FY2018, profits grew 27% compared to the year before. It is to note that in their financial statements, they reported two numbers for their net profit. The difference is as shown below.

The difference in 2017 was mainly due to the realisation of fair value adjustment reserve upon change of interests in Vietnam Dairy Products Joint Stock Co (Vinamilk). Thus for the profit of FY2018, we will compare it with the profit of FY2017 before fair value adjustments and exceptional items, as some of these are one-off events, and there is an increase in profit from FY2017 to FY2018 of +27.08%.

As for dividends, they paid out a total dividend of 4.5 cents/share for the year, constant with FY2017, with a payout ratio at 53.6%.

1H2019 performance

The financial performance of F&N for 1H2019 for the period ended 31 March 2019 showed an increase. Revenue increased early in 2019 due to the Chinese New Year sales. The increase in revenue was fueled by Dairies increased earnings of 43%. It offsets the decrease in beverages earnings which had higher marketing spending and distribution costs, and pre-operating costs incurred at the new brewery in Myanmar.

Revenue portfolio

SWOT Analysis

Strengths

F&N is rolling out some new products into their range of F&B.

Healthier products: introducing lower sugar content into some of their drinks.

New products: F&N MAGNOLIA Plus Lactose-free milk innovation.

Portion control packing: introducing 100 plus in 250ml pack

These new innovations are seeking to meet changing market trends.

Weaknesses

F&B Industry

Having operations in different countries, they will be subject to foreign exchange risks since they have transactions arising from trading and investment activities. The company tackles this by hedging 50% to 90% of anticipated exposures.

Publishing & Printing

Their diversification into Publishing & Printing is not serving them well, and revenue decreased 9% in 1H2019 compared to 1H2018. This was due to a drop in magazine-related demand for both print and distribution and lower publishing sales in Singapore and Hong Kong. Are they better off not having this segment of diversification? In Singapore, the demand for the print magazine is persistently declining. They are trying to offset this by diversifying into China and Malaysia to cushion the drop for traditional print materials. Furthermore, worldwide paper prices are decreasing, leading to increased costs.

Opportunities

The Group’s strategy is to expand into new markets, which are emerging markets. This brings in increased revenue streams and could yield better profit figures as competition is lowe. They also entered into the food business in Thailand, having roughly 20.75% in Genki Sushi Bangkapigenki.

Threats

As mentioned previously, there are met with shifting consumer behaviour and industry trends. Consumers are increasingly health conscious and going for “less sugar” products. They are adding new items into their range, but it is unsure whether consumers will be getting these lower-sugar-but-still-high-in-sugar drinks or rather into say, healthier fruit juices instead. #fitspo

On top of that, they are faced with new regulations. From 1st July 2019, Malaysia will impose a sugar tax on soft drinks and juices of 40 sen per litre. How will this affect F&N? Taking a look at their revenue by geographical region, we can see that Malaysia accounts for the greatest percentage of their total revenue. With this tax, their profit will be negatively impacted, and hence put a dent in their portfolio as a result.

Conclusion

The price of F&N is near its 52-week low and new products are put in existing markets. On top of that, they are looking at growth into emerging markets where they will face lower competition which means higher profits. However, they are faced with changing consumer demands and subject to regulations, which will impact their earnings, and despite rolling out new products aiming to counter that, there is still uncertainty whether it will be well-received in the markets.

TL;DR: Fraser & Neave stock is trading near its 52-week low. FY2018 profits increased 27% and 1H2019 profits jumped 80% YoY compared to 1H2018*. Lets take a look at the summary of this stock!

Business overview

Established in 1883, Fraser and Neave, Limited (“F&N”) is known by us more for its drinks, including 100 plus, F&N drinks, Ice Mountain, Vinamilk and Chang Beer. Under F&N Limited there is not just the Food & Beverage but they are also in the Publishing & Printing industry - Marshall Cavendish (such as some of our textbooks!), but this post will mainly talk about their F&B segment.

Share price

Credits: Yahoo Finance

Currently, F&N Limited is trading at $1.74 (as of writing on 15 May 2019), with the 52week L/H at $1.67/$2.10. The current P/E ratio is 16.36.

*1H2019 profits jumped 80% YoY compared to 1H2018, calculated based on attributable profit before exceptional items, comparing 6 months to 31 March 2019 to one year before (6 months to 31 March 2018).

Financials

In FY2018, profits grew 27% compared to the year before. It is to note that in their financial statements, they reported two numbers for their net profit. The difference is as shown below.

The difference in 2017 was mainly due to the realisation of fair value adjustment reserve upon change of interests in Vietnam Dairy Products Joint Stock Co (Vinamilk). Thus for the profit of FY2018, we will compare it with the profit of FY2017 before fair value adjustments and exceptional items, as some of these are one-off events, and there is an increase in profit from FY2017 to FY2018 of +27.08%.

As for dividends, they paid out a total dividend of 4.5 cents/share for the year, constant with FY2017, with a payout ratio at 53.6%.

1H2019 performance

The financial performance of F&N for 1H2019 for the period ended 31 March 2019 showed an increase. Revenue increased early in 2019 due to the Chinese New Year sales. The increase in revenue was fueled by Dairies increased earnings of 43%. It offsets the decrease in beverages earnings which had higher marketing spending and distribution costs, and pre-operating costs incurred at the new brewery in Myanmar.

Revenue portfolio

SWOT Analysis

Strengths

F&N is rolling out some new products into their range of F&B.

Healthier products: introducing lower sugar content into some of their drinks.

New products: F&N MAGNOLIA Plus Lactose-free milk innovation.

Portion control packing: introducing 100 plus in 250ml pack

These new innovations are seeking to meet changing market trends.

Weaknesses

F&B Industry

Having operations in different countries, they will be subject to foreign exchange risks since they have transactions arising from trading and investment activities. The company tackles this by hedging 50% to 90% of anticipated exposures.

Publishing & Printing

Their diversification into Publishing & Printing is not serving them well, and revenue decreased 9% in 1H2019 compared to 1H2018. This was due to a drop in magazine-related demand for both print and distribution and lower publishing sales in Singapore and Hong Kong. Are they better off not having this segment of diversification? In Singapore, the demand for the print magazine is persistently declining. They are trying to offset this by diversifying into China and Malaysia to cushion the drop for traditional print materials. Furthermore, worldwide paper prices are decreasing, leading to increased costs.

Opportunities

The Group’s strategy is to expand into new markets, which are emerging markets. This brings in increased revenue streams and could yield better profit figures as competition is lowe. They also entered into the food business in Thailand, having roughly 20.75% in Genki Sushi Bangkapigenki.

Threats

As mentioned previously, there are met with shifting consumer behaviour and industry trends. Consumers are increasingly health conscious and going for “less sugar” products. They are adding new items into their range, but it is unsure whether consumers will be getting these lower-sugar-but-still-high-in-sugar drinks or rather into say, healthier fruit juices instead. #fitspo

On top of that, they are faced with new regulations. From 1st July 2019, Malaysia will impose a sugar tax on soft drinks and juices of 40 sen per litre. How will this affect F&N? Taking a look at their revenue by geographical region, we can see that Malaysia accounts for the greatest percentage of their total revenue. With this tax, their profit will be negatively impacted, and hence put a dent in their portfolio as a result.

Conclusion

The price of F&N is near its 52-week low and new products are put in existing markets. On top of that, they are looking at growth into emerging markets where they will face lower competition which means higher profits. However, they are faced with changing consumer demands and subject to regulations, which will impact their earnings, and despite rolling out new products aiming to counter that, there is still uncertainty whether it will be well-received in the markets.