Anonymous

Semi sandwiched generation and it's kinda stifling... need a bit of advice on my situation. What should I do?

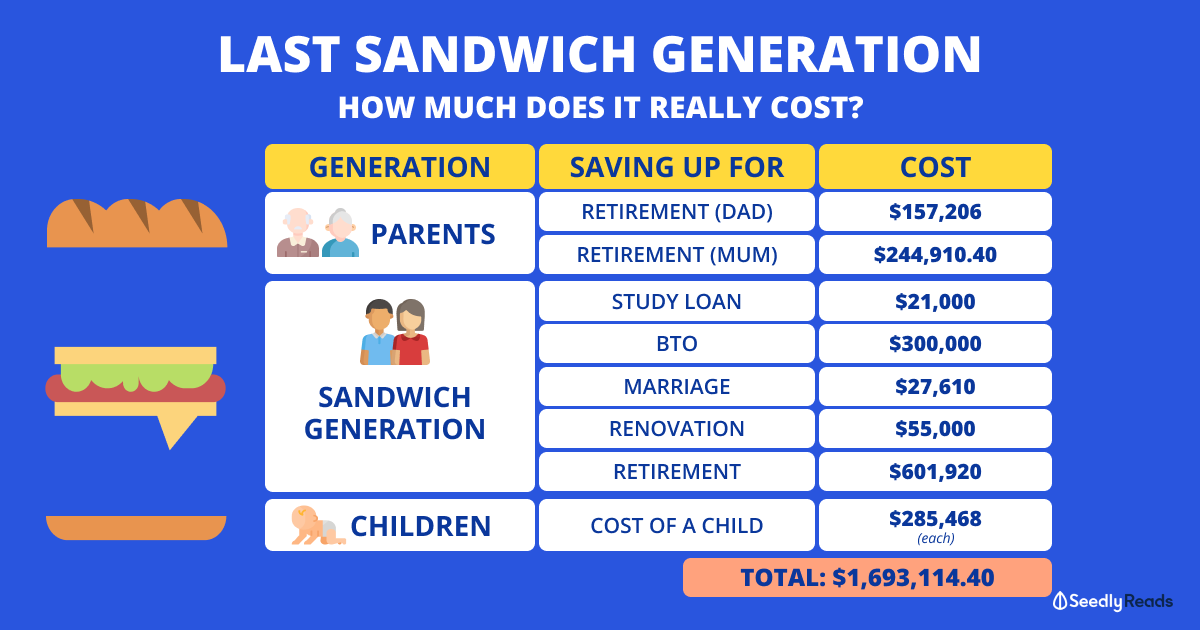

34 y/o. Technical industry ~9yrs. 3.68K/mth net aft deducting CPF. Mom housewife. Monthly expense 1.6k incl. mom allowance. No car. Dad freelance project sales for industrial factory equipment. Wish to stay single bc i want to FIRE, been saving & building wealth in stocks. Hv abt 200k+ cash, 20k stock. 200k CPF. Hv loaned dad 20k for business so far, he faces a cash flow problem. Now he proposes I partner with him instead of outsiders to inject capital, Profit 50:50. FI might delay if I help dad

25

Discussion (25)

Learn how to style your text

Reply

Save

Pang Zhe Liang

18 Feb 2020

Fee-Based Financial Advisory Manager at Financial Alliance Pte Ltd (IFA Firm)

Firstly, we should start by having a detailed understanding about yourself. This can be done in two parts:

Part 1: Consolidation for your Insurance Portfolio

One of the most important things to do is to have a complete understanding of your existing insurance portfolio. Through this process, it allows us to understand the coverage that we have, any financial gap, as well as to find out whether we are overpaying for our insurance policies. I have highlighted the rest of the reasons here: https://www.blog.pzl.sg/why-every-client-needs-...

Part 2: Understanding Your Cashflow

Secondly, we need to have a complete understanding on our cashflow. Through this process, we will understand our earning ability and spending habit. Here is a guide to help you: https://www.blog.pzl.sg/understanding-your-pers...

Through a detailed process, we are able to scrutinise and check whether we will be able to increase our income or reduce our expenses. Moreover, knowing when we will receive our bonus helps in your overall financial planning.

Concern 1: Attaining FIRE

Attaining FIRE is overrated for the most part. Instead, you should focus on living the life that you want now and to stay in good health. I read some of your comments below and understand that you are open to having a partner. In this case, then you should be open to dating. Just because you are dating does not mean that you should stop pursuing FIRE. On the contrary, look for a partner (I know it is easier said than done) who shares similar dreams and goals with you.

As a result, your partner will be able to motivate you so that both of you can reach greater heights together.

Concern 2: $200k Cash

In Part 2 (above), we conducted a cashflow analysis. Now, the question to ask is, "do you need so much liquidity?" If not, then most of your money could be placed in better tools that are capable of helping you reach your goals, rather than to deflate as cash over time.

Generally, the idea is to create a well-diversified portfolio that is capable of helping you reach your goals in a more efficient manner. Time is running short. In fact, we probably have less than a quarter of our life left before we need to retire. Hence, plan your cashflow to this end.

Concern 3: Business Partner

In summary, more information is required in order to understand if it is a feasible investment as a partner. If there is a good 10 to 15 years plan that makes sense to you, then go for it. Otherwise, work things out with your dad to find out how both of you can make this business profitable. When done right, this may help you reach FIRE earlier rather than later. The key is always, "how well can you overturn and run a business?"

Concern 4: Comprehensive Planning

All in all, I feel that you are feeling confused and perhaps burned-out in your life and needs someone who is capable to lead you in the right direction. For the most part, this can be easily resolved by writing everything down and analyse it on your own or seek a mentor. When done right, you will be able to propel forward at a remarkable speed.

Here is everything about me and what I do best.

Reply

Save

Without knowing your dad's business but I would think that is still developing whilst you are doing reasonably well in your current job. As such, it will be a great risk in letting go your stable income to a riskier business together.

You are putting all 2 eggs in a single busket for your family.

Reply

Save

How do you gauge your dad's business on the long term future? The fact that you already pumped in 20K must mean there is a potential waiting to be developed.

Focus on the items on hand 1st, why is your dad requiring more capital? Inflating costs? Shouldn't be the case now. My guess is he is over budgeting. Look into his cashflow and address areas of concern as soon as possible. Your goal is to help grow his business so much so that he can self suffice and return you your capital.

That on its own has a bigger impact that to just get back your 20k invested.

With regards to the other items in question, you have all the other experts here in this platform. Growing and investing. Remember, capital appreciation is tax free.

So you'd guess which is the greater nemesis.

Cheers.

Reply

Save

Lim Chun Long Jimmy

17 Feb 2020

Co-founder at PolicyWoke (Traded Endowment Policies)

Hi,

Sorry to hear about your difficult situation.

Does your Dad have any cash-value insurance poli...

Read 6 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Few years back I also have thoughts of staying single, it seems like a short cut to fire. I think its extremely important to decide how you want to live your life, it's really not that long. We sleep 1/3 of the day, and assuming you live still 90, that's like only 38years left. For some people it's even shorter, they get dementia as early as in their 40s. There are also many things that we can't do when we are older, even when FIRE with alot of money; having babies, lending $$ to parents (they probably moved on) for example. Money is a tool to solve problems, if money can't do that, it's just a number. In our 30s-40, that like our last golden decade to find a partner, get married, have babies, travel, buy nonsense, eat junk food, etc. Sure for some guys, they can still do it even when they are in their 60s or 70s, but I don't think it will be the same. Be careful not to lose the balance, not to lose moments, relationships, experiences , in exchange for FIRE. If you have the capacity and can use money to help and support a love one, there's really nothing much to think about. U have $420, papa ask only $20. If he loses everything, that's life and you should accept it.