Anonymous

After going through all of the robos in the market, i've narrowed down to autowealth and endowus. Which would you recommend or prefer, please share reason too?

Would you recommend autowealth and endowus?

7

Discussion (7)

Learn how to style your text

Reply

Save

Gabriel

17 Dec 2020

Undergraduate at National University of Singapore

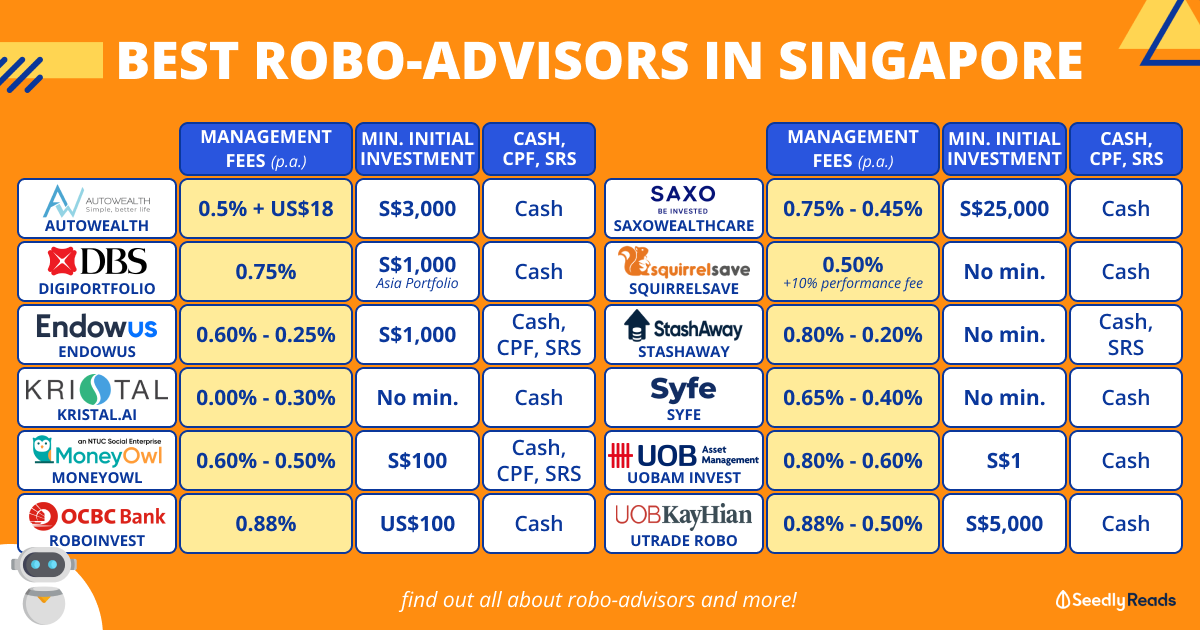

Hey Anon, this is a tough decision to make. I love both Endowus and AutoWealth, and both robo-advisors have a place in my portfolio (https://seedly.sg/questions/are-you-willing-to-...). However, if I can only choose one, I'll go with Endowus! Here are the reasons why you should go with Endowus or AutoWealth -

- Why Endowus?

1) Access to Dimensional Funds

Endowus is one of the cheapest and easiest ways to get access to Dimensional funds (DFA). Previously, you can only buy Dimensional funds through a financial advisor or broker approved by DFA which means that you can't simply do-it-yourself through a brokerage platform such as FSMOne or Dollardex. In contrast, the ETFs which AutoWealth or any other robo-advisor (StashAway/Syfe) uses, can be easily replicated and constructed on your own using any brokerage platform.

2) All-in-One Platform

Endowus is an all-in-one platform that allows you to invest your cash, SRS, and CPF. This makes it a holistic platform and from my understanding, this is one of the reasons why people use Endowus - the convenience of being able to deploy their cash, SRS, and CPF to work towards their goals all on one platform. Not to mention, currently Endowus is the only robo-advisor that allows you to invest using your CPF. In comparison, AutoWealth only supports cash for now.

3) FX and Tax-Friendly

The funds used by Endowus are both FX and tax-friendly. Equities are SGD-denominated while bonds are SGD-hedged, and this means that you do not get exposed to FX volatility, removing any FX risk and cost. It's also tax-efficient as you won't be subjected to the 30% US withholding tax.

- Why AutoWealth?

1) Same Day Deployment of Funds

While ideally, we shouldn't try to time the market, I'm sure that some of us would like our funds to be deployed as soon as possible especially if the market dipped quite a bit the previous day. For AutoWealth, your funds will be deployed on the same day when the market opens at night, so long as you deposit your funds before 5 pm. From my experience thus far, the funds usually appear in my SAXO account almost immediately and have been deployed on the same day. In contrast, Endowus has a lead/lag time of one day. This means that if I deposit some funds today, it'll only be received and deployed the next working day. Ultimately, I don't think that this is much of a deal-breaker given that the purpose of using a robo-advisor is to "deposit and forget" and not time the market.

2) Rebalancing during Periods of Volatility

During periods of volatility, AutoWealth will actively rebalance your portfolio to buy equities at a discount and after it recovers, it will rebalance again to take profit from the equities as well as to bring your portfolio allocation towards your portfolio allocation. According to AutoWealth, their balanced portfolio earned an extra 3.5% returns in March 2020, during the market downturn/COVID selloff. These extra returns can in turn, be used to offset the management fees paid to AutoWealth.

3) Dedicated Wealth Manager & Timely Market Updates

For AutoWealth, each client is assigned a dedicated wealth manager who is just one message away for any queries you may have. This is great if you're someone who needs some hand holding to guide you through your investing journey. AutoWealth also has a Telegram group where they will provide updates on the market as well as opportunities for a lump sum deposit during a market correction - great for those who don't monitor their portfolio.

Hope this helps you to make an informed decision!

Reply

Save

Jiayee

15 Dec 2020

Salaryman at some company

I went with Endowus for the following reasons:

No need to worry over the various US taxes

Ca...

Read 1 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Products

AutoWealth

4.8

218 Reviews

ETFs, Equities, Bonds

INSTRUMENTS

0.5%

ANNUAL MANAGEMENT FEE

$3,000

MINIMUM INVESTMENT

N/A

EXPECTED ANNUAL RETURN

Web only

PLATFORMS

Endowus

4.7

656 Reviews

StashAway

4.7

1293 Reviews

Related Posts

Or Does it make sense to use 2? Maybe autowealth for cash and Endowus for srs and cod